AIM-listed Hercules has bought a 70% shareholding in Warrington-based Lyons Energy Products and services (LPS), a expert supplier of energy and effort infrastructure services and products.

The £702,800 transaction is to be happy part in money and part in stocks. The remainder 30% shareholding in LPS will proceed to be held by way of the present proprietor supervisor of LPS, David Lyons, who will stay actively fascinated by LPS.

LPS, based in 2018, operates inside the energy and effort infrastructure sector, offering specialist services and products to shoppers, which come with producers comparable to Siemens and distribution community operators comparable to SSE, inside the transmission, distribution, and effort markets. Its services and products come with the set up and commissioning of switchgear and substation methods.

Within the 12 months to 31st January 2025, it generated revenues of £1,387,000 and benefit ahead of tax of £287,000.

The purchase follows Hercules’ takeover of overhead linesmen provider Benefit NRG in June this 12 months, additional widening its already shopper base within the power and gear sectors.

Hercules leader govt Brusk Korkmaz stated: “We’re happy to welcome Lyons Energy Products and services into the Hercules Staff. This acquisition strengthens our presence within the crucial energy and effort infrastructure sector, offering each diversification and long-term enlargement alternatives.

“LPS and its experience within the booming energy and effort sector will dovetail properly with our earlier acquisition, Benefit NRG. The partnership construction guarantees that we retain the entrepreneurial power of the LPS control crew, whilst leveraging Hercules’ assets to scale the trade additional.”

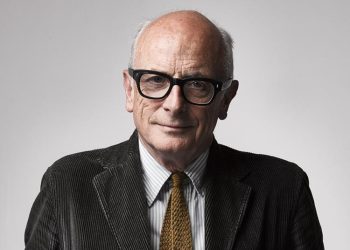

David Lyons, managing director of Lyons Energy Products and services, added: “Hercules’ scale, recognition, and shopper relationships will let us boost up our enlargement whilst proceeding to ship the top quality services and products our shoppers be expecting. We imagine our imaginative and prescient for the long run is aligned with that of the Hercules control crew at what’s an exhilarating time for the infrastructure sector.”

Underneath the phrases of the partnership settlement, David Lyons can promote his closing 30% pastime to Hercules, between the 7th and tenth anniversary crowning glory, at a attention in line with a a couple of of 4 instances the common EBITDA accomplished by way of Lyons Energy Products and services within the two years previous the minority pastime sale. After 10 years, Hercules has the best to procure any closing minority pastime held by way of Lyons, in line with the similar calculation.

Were given a tale? E mail information@theconstructionindex.co.united kingdom