Finance Your Skid Steer Attachments With

Skid Steers Direct

Skid Steer attachments are dear. No longer each and every trade or operator has the money to buy new or used apparatus when wanted. With our finance spouse CIT Small Trade Answers, Skid Steers Direct is delighted to supply one of the most perfect apparatus financing plans.

In those unsure financial instances, folks need a nest egg. Financial savings take time, and producing the income you wish to have first is difficult with out the fitting equipment.

Our financing merchandise benefit from Segment 179 of the IRS tax code to supply low to no cash down skid steer financing with a very simple and obtainable fee plan. This can be a distinctive financing program that we have got put paintings into to ship a novel credit score product for apparatus consumers.

How To Follow For Financing

- Each and every product and weblog web page has an orange hyperlink to our financing utility web page.

- Fill on your elementary trade data.

- Get immediately licensed for as much as $250,000 in financing.

Our lending supervisor will touch you for additional info if you happen to don’t seem to be immediately licensed. We will frequently proper problems and have you ever licensed. After you have your approval, there are a couple of less difficult steps:

- Our gross sales crew will touch you to create a purchase order order on your apparatus.

- Our lending supervisor provides you with a number of other mortgage phrases.

- After you have agreed on phrases and digitally signed the contract, you’re all achieved! We will be able to now procedure your order.

Click on The Hyperlink Beneath To See Your Pre-approval Quantity With No Legal responsibility

How To Save Cash By means of Financing Skid Steer Attachments

[Consult your accountant for a complete understanding]

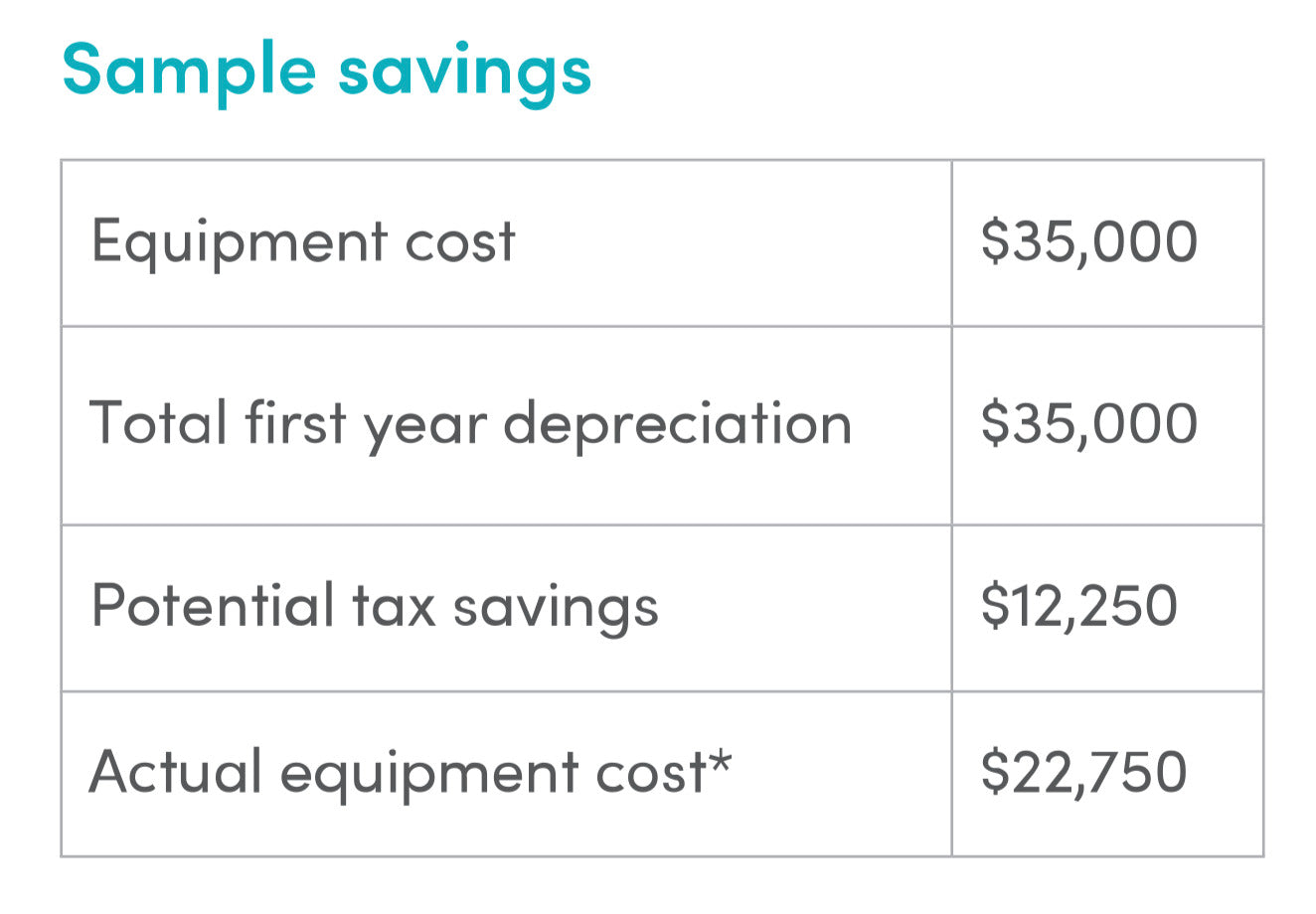

Segment 179 of the IRS tax code we could companies deduct the entire acquire value of qualifying apparatus financed all over the tax 12 months as much as $1,080,000. Bonus depreciation could also be to be had to people who acquire over $2,700,000 in qualifying apparatus!

Merely put, if you are going to buy a skid steer attachment, you might be able to totally depreciate it straight away on supply. This depreciation can decrease your tax invoice, which leads to general financial savings at the attachment.

If you happen to finance this totally depreciated attachment, you lower your expenses now and pay for the apparatus later, as you utilize it to generate profits!

Instance

1) Acquire a brand new piece of apparatus and start the usage of it earlier than December thirty first of this 12 months

2) Settle for complete willpower of apparatus depreciation up entrance quite than over a number of years

3) Lower your expenses NOW in your base line

Extra Advantages Of Financing Your Apparatus

Rapid Utility and Approval

And not using a cash down financing plans, get started producing income together with your skid steer or attachment straight away, making bills as you cross. Our fast and handy on-line utility portal will get you credit score lately with out dropping crucial productive time spent saving or risking your hard earned reserves.

Attachment Bills Are Taxed Favourably

Financed apparatus can also be devoted as an working expense within the duration through which it is paid, which reduces the total price. Bills also are handled as bills at the source of revenue sheet, so there is no wish to fear about depreciation.

Pay as you Move

Making per thirty days bills as you cross helps to keep your money on your pocket and lets in the apparatus to pay for itself because it generates income for your online business.

Aggressive Charges

In finding out what your per thirty days bills can be with our price calculator. Finance your attachments with our rapid and handy utility portal, or touch our mortgage spouse James Kelley with CIT, for more info.

https://skidsteersdirect.directcapital.com/

Often Requested Questions

What sort of credit score do I would like?

We provide quite a lot of charges and choices relying in your credit score rating.

How lengthy does the approval procedure take?

Conventional turnaround time is best 2-3 days, in comparison to 2-3 weeks at many fiscal establishments and credit score unions.

What does a standard reimbursement duration appear to be?

Phrases between 6-72 months are to be had. Maximum consumers make a choice 38 per thirty days mortgage bills.

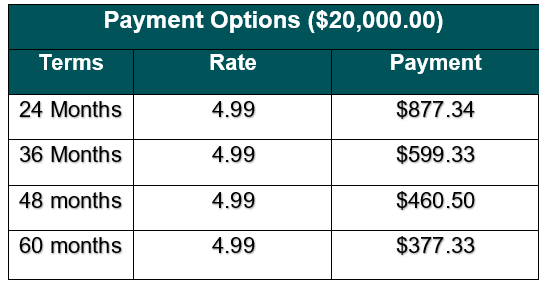

What is going to my per thirty days fee be?

Bills is determined by the scale of your mortgage, however our charges might be similar throughout phrases. The appliance portal will allow you to see what the most productive financing choices are for you. See underneath a useful calculator chart on a pattern $20,000 mortgage. As you’ll be able to see, our financing plans ship just right offers at honest and decrease charges.

What sort of data do I wish to supply?

Many candidates obtain pre-approval robotically without a documentation required, particularly for loans underneath $250,000.

Can I am getting financing to shop for via distributors as opposed to Skid Steers Direct?

Sure, you’ll be able to. Whilst we would like to have your online business, you’ll be able to get admission to credit score during the “Skid Steers Direct Capital” utility portal after which take your mortgage to the provider of your selection. The mortgage may also be used at a couple of distributors and supplemented with money in advance.

Can I buy a couple of piece of apparatus with this mortgage?

Sure! Many purchasers have even used this financing program to get attachments and kit from a couple of seller. One buyer bought financing via our Skid Steers Direct financing spouse, bought from one in every of our competition, after which applied leftover finances to shop for an extra $250,000 with us, paying money at the distinction between their closing credit score and the acquisition value. The original procedure and lending courting let us stay the similar charges without reference to the place the client is buying from

How a lot credit score am I eligible for?

The total acquire value of as much as $1,080,000 is to be had in apparatus financing via CIT and Skid Steers Direct.

Who Supplies the Mortgage?

Our distinctive skid steer financing merchandise are presented via our spouse CIT First Electorate Financial institution and Agree with Corporate.

How are you providing no cash down?

Those loans are made conceivable via consumers accepting complete willpower of apparatus depreciation up entrance quite than over a number of years and benefiting from Segment 179 of the IRS tax code. This makes the economics paintings for the lender and lets you pay much less taxes. Preforfeiting the depreciation, which might occur in any case over the gadget’s carrier lifestyles on your care, is not a lot of a sacrifice!

Further useful data

- True Industrial Mortgage = Debt is reported to the client’s trade solely.

- Financing from $2,000 – $500,000 APP best

- No penalty for paying off early

- Financing for EQUIPMENT + SOFT COSTS (tax, transport, set up, and so on.).

- Charges are generally aligned with client mortgages.

The place can I am getting additional info?

CIT Consultant James Kelly is to be had so that you can touch via telephone or e mail to offer any data and allow you to with any questions:

james.kelley2@cit.com

(603) 373-1390

How do I observe?

Skid Steers Direct on-line apparatus financing portal “Direct Capital”. Click on the hyperlink or in finding it on our site when surfing our intensive number of the most productive emblem and useful recommendation. We have now the most productive choices, from credit score to apparatus, to get apparatus to give you the results you want now. (https://skidsteersdirect.directcapital.com/)

Testimonials

Derek Dicks, Apparatus financing trade buyer. [prosource machinery]

“Even supposing CIT handles the transaction from begin to end, I by no means really feel like I lose keep an eye on of the transaction. I’m knowledgeable during the method and not left in the dead of night a few transaction. It’s seamless,”

“My favorite factor about CIT is they’ll resolution the telephone and inform me the place we’re at within the procedure. That sounds a little bit bit elementary, however imagine me, there are folks in the market that don’t do this,”

“I’d indisputably level different IEDA individuals to CIT; We all know the method works with CIT. They’ve been a super best friend for us to lend a hand get our consumers financed.”

Paul Lashin Apparatus financing trade buyer [Prestige Equipment]

“You need to transfer a lot quicker, be nimble, and be offering extra choices,” stated Lashin of lately’s apparatus marketplace. Financing is a side of the trade which I imagine could be very useful in giving somebody the additional edge to make a deal.”

“CIT could be very fast to reply and takes a hands-on way. In the event that they’re running the financing finish of the deal, we aren’t involved that our buyer goes to get misplaced within the shuffle or fall during the cracks,”

“It’s necessary to notice,” he endured, “that even if what we do is purchase and promote iron, our trade is truly a folks trade. Having the fitting relationships with folks you’ll be able to agree with is crucial if you happen to’re to have long-term good fortune in our trade.”

“We all know we will agree with CIT, and we truly imagine them circle of relatives in a way… and I imply that sincerely.”